How Stablecoin Usage Varies Across the World

Analysis of $13.6T in transactions reveals geographic differences in how the world uses stablecoins across chains

Executive Summary

We analyzed three months of transactions from wallets holding stablecoins across Ethereum, Base, BSC, Tron, and Solana – the five largest stablecoin networks representing $13.59T in transaction volume from July to September 2025. By mapping when these wallets holding stablecoins were active, we can infer where users are located globally.

Stablecoin usage is truly global, but not uniformly distributed. Three clear patterns emerge from the data:

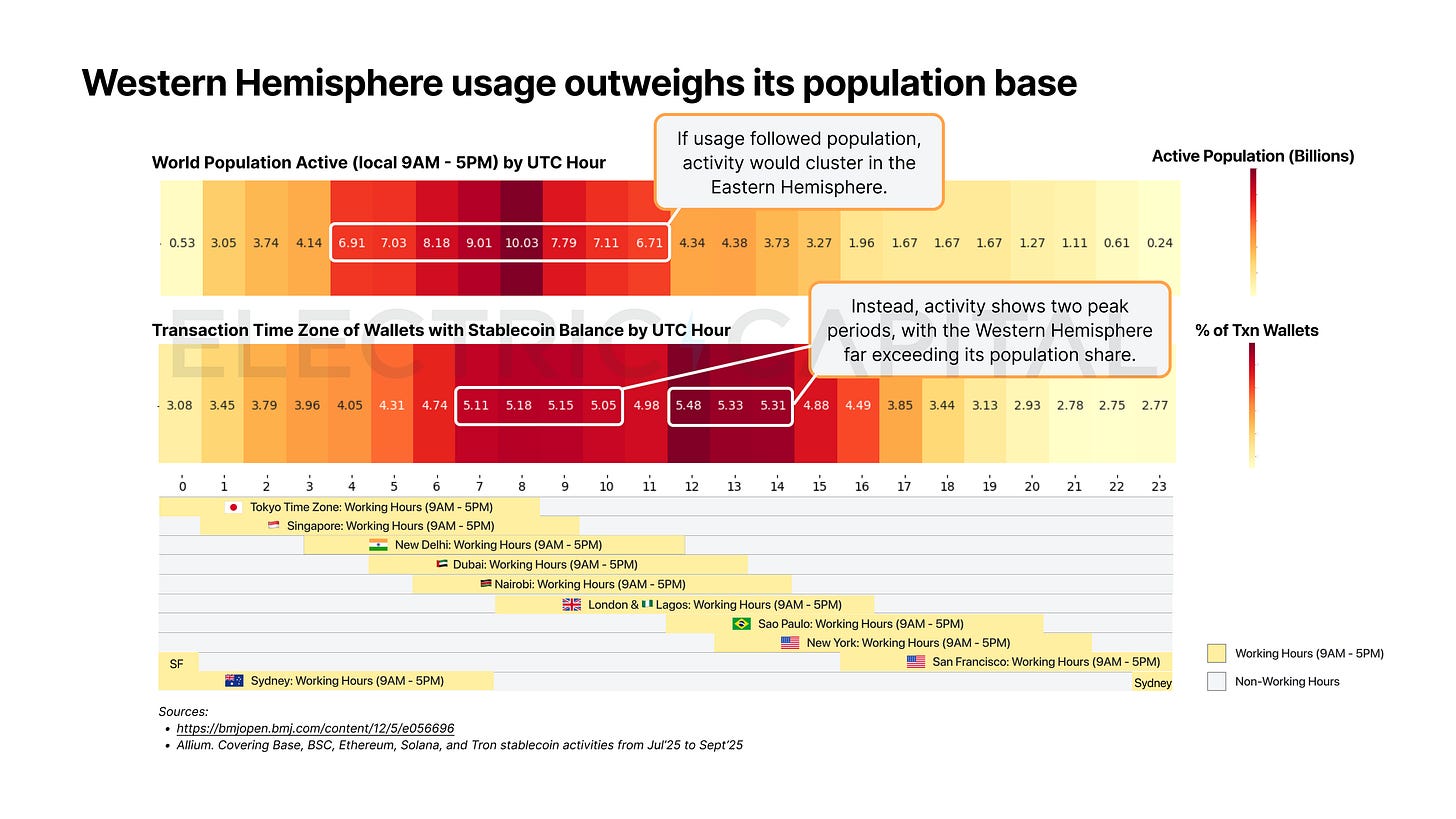

The Americas drive disproportionately high activity. Despite representing a smaller share of global population, Western Hemisphere users generate stablecoin transaction volumes comparable to, or exceeding, far more populous regions. This suggests significant room for stablecoin growth in other parts of the world, particularly in high-population regions where adoption rates remain relatively low.

Different chains serve different geographies. BSC and Tron are heavily concentrated in Asian, Middle Eastern, and African markets, with minimal Western activity (<3% activity during Western working hours). Ethereum, Solana, and Base show broader geographic reach than BSC and Tron, with active participation spanning multiple time zones.

Large and small wallets occupy different geographies on some chains. Base and Solana show clear separation, with large wallets (likely institutional) concentrating in Western financial hubs while small wallets (likely retail) are globally distributed. In contrast, BSC, Tron, and Ethereum show alignment between wallet sizes, suggesting more geographically unified user bases.

Important caveats:

Wallets are not individuals

Each wallet represents an address, not a person. The geographic distribution of people could differ if the average number of wallets per user varies by region. This analysis assumes that wallet ownership per person is uniformly distributed across the globe.

Geographic inference is based on typical working hours

We infer geography from wallet activity between 9 a.m. to 5 p.m. local time. However, if stablecoin users in some regions tend to transact outside these hours, the regional mapping could shift. While stablecoin activity does occur at all hours, this analysis assumes that early risers and night owls are roughly evenly distributed worldwide, making this 9 a.m. to 5 p.m. framework directionally valid for identifying primary activity zones.

Our complete methodology is at the end of this post.

Stablecoin usage is global, but the West has disproportionately high activity

We begin by analyzing activity across all five chains together to identify broad patterns in global stablecoin usage.

Stablecoin activity shows two distinct peaks across different regional hubs

Stablecoin activity is not confined to a single geography. Instead, usage spreads across time zones, with two distinct peaks:

UTC 8 — when working hours in Asia, the Middle East, Africa, and parts of Europe overlap

UTC 12 — when working hours in the Middle East, Africa, Europe, and Latin America overlap (U.S. East Coast joins at UTC 13)

This dual-peak pattern indicates stablecoin demand is shaped by several regional hubs, rather than dominated by one geography.

But the Western Hemisphere punches above its weight

If adoption simply followed population distribution, activity would cluster heavily in the Eastern Hemisphere (UTC 4–11), where most of the world lives (shown above).

Instead, the peak at UTC 12 reveals the Western Hemisphere’s outsized influence: despite having a smaller population base, the Americas generate stablecoin activity exceeding more populous regions.

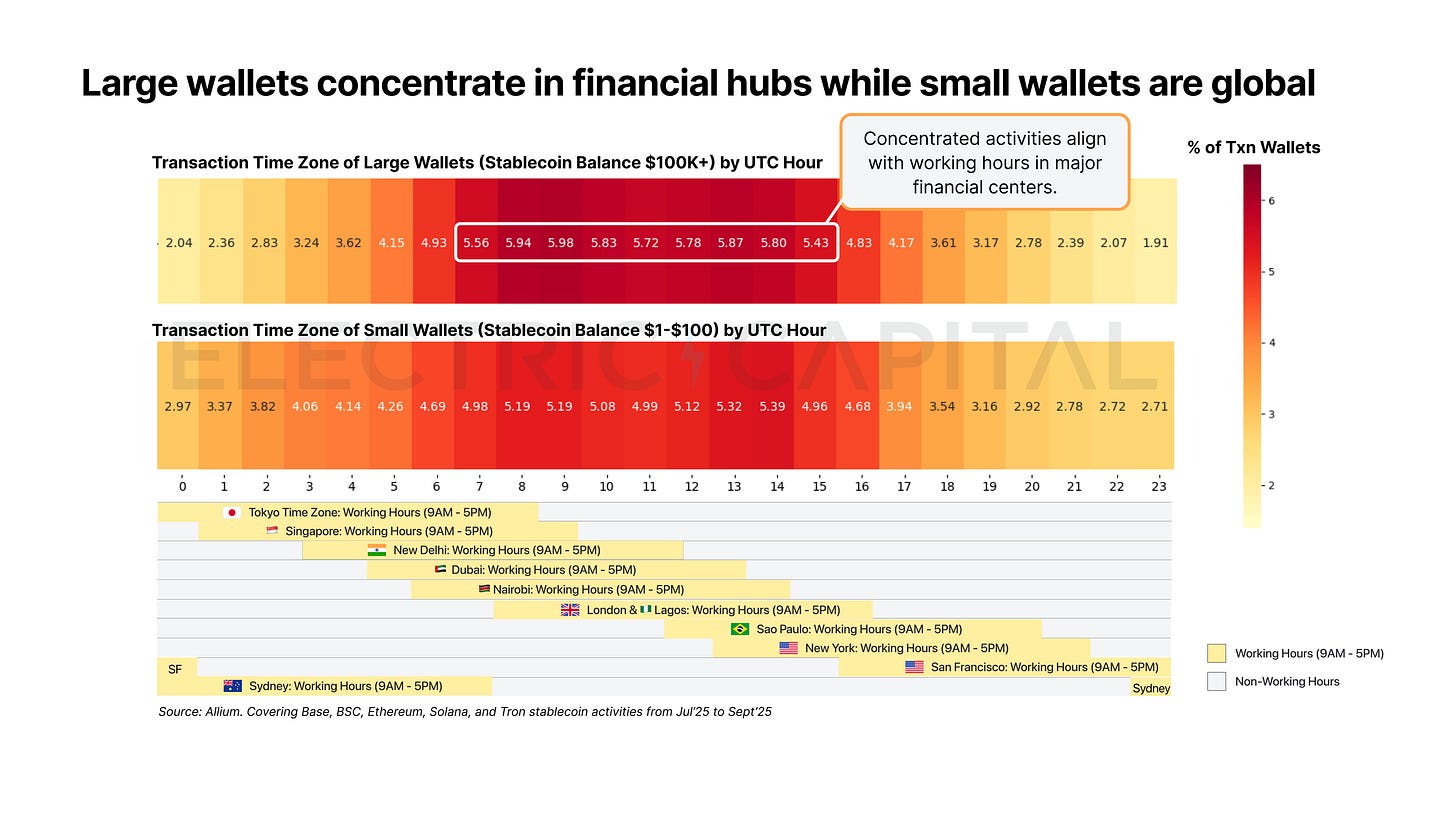

Large wallets concentrate in financial hubs while small wallets are globally distributed

We now segment wallets by their stablecoin balance to understand whether different user types behave differently. As of Oct 1st, 2025, about 0.3% of wallets hold more than $100K, while 80.4% hold between $1–$100. These groups show distinct geographic patterns.

Large wallets cluster around traditional financial centers

Large wallets ($100K+) show concentrated activity between UTC 7–15, aligning with working hours across Asia, the Middle East, Europe, and the U.S. East Coast. This pattern suggests institutional or professional users operating during business hours in major financial centers.

Small wallets show broader global adoption

Small wallets ($1–$100) exhibit broader activity across all time zones, without the sharp concentration drops seen in large wallets. This distribution indicates everyday users transacting throughout the day across diverse geographies.

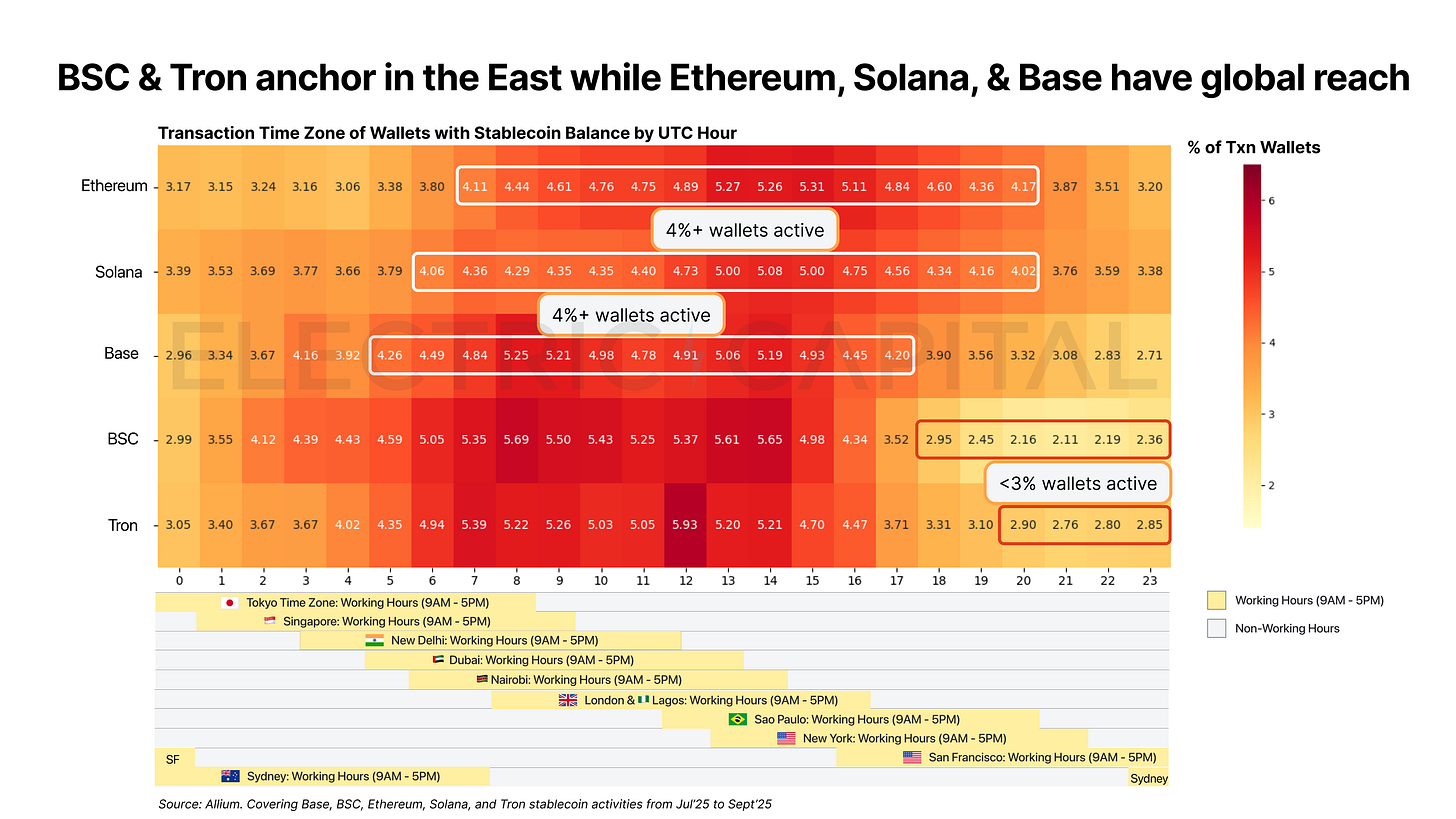

BSC and Tron remain anchored in the Eastern Hemisphere while Ethereum, Solana, and Base have global reach

Next, we segment stablecoin activity by chain to see whether different networks serve different parts of the world. The answer: some chains have achieved global distribution while others remain regionally concentrated.

Ethereum and Solana exhibit balanced global usage

Ethereum and Solana display activity distributed across both hemispheres, with strong participation during both Eastern (UTC 7–11) and Western (UTC 13–16) working hours. These chains have successfully penetrated markets worldwide.

BSC and Tron are anchored in Asia, Middle East, and Africa

BSC and Tron show remarkably similar patterns, with activity concentrated between UTC 6–15 — aligning with working hours across Asia, the Middle East, and Europe. Both chains see less than 3% of activity during U.S. hours, indicating minimal relative Western adoption despite their large overall user bases.

Base shows emerging global reach

Base demonstrates more geographic diversity than BSC or Tron, with meaningful activity across multiple time zones. While not yet as globally balanced as Ethereum or Solana, Base shows Western Hemisphere strength alongside growing adoption in other regions.

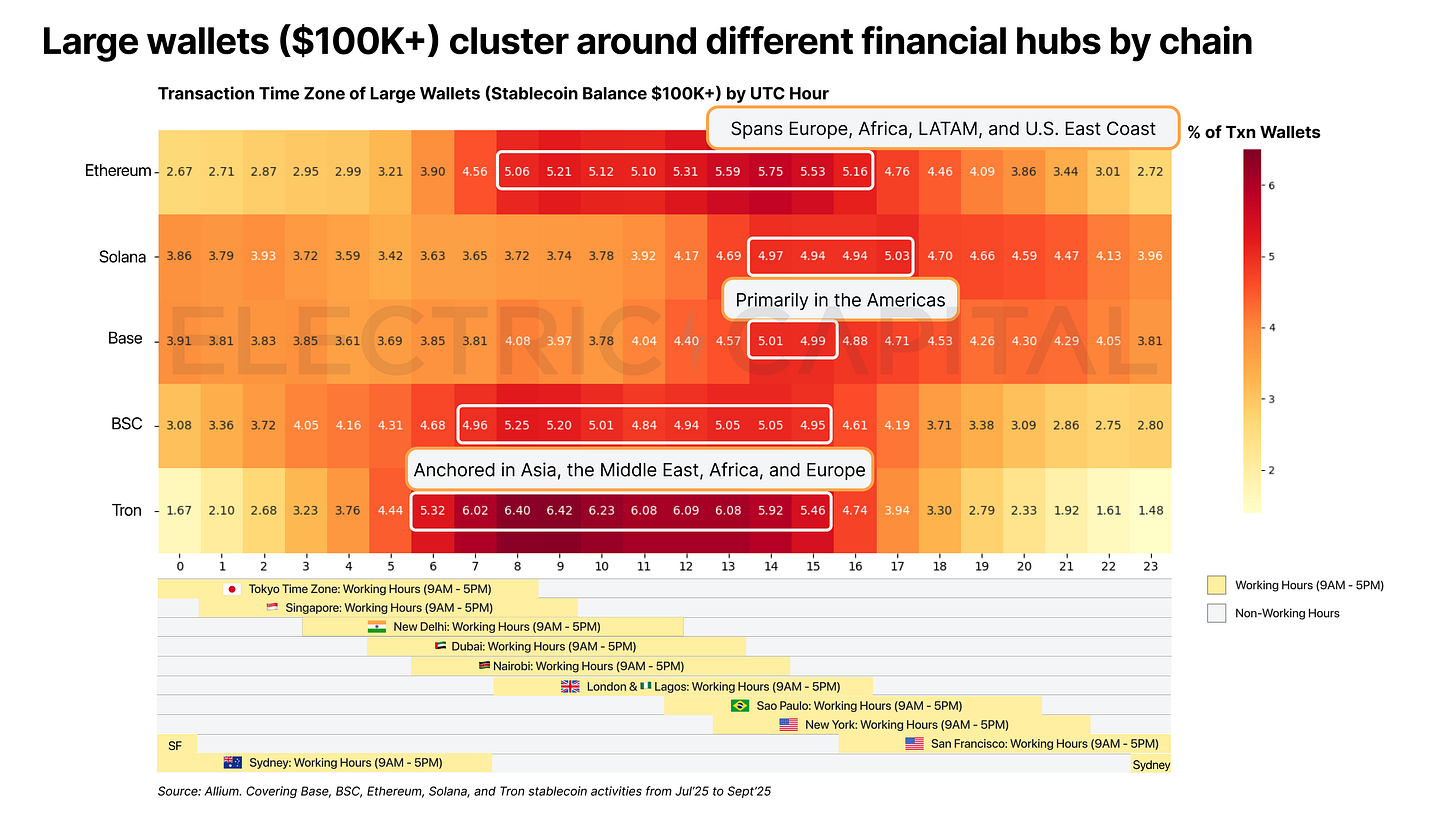

Large and small wallets cluster differently across chains

Breaking down activity by both chain and wallet size reveals distinct patterns. Large wallets, which may indicate institutional or professional users, show different geographic concentrations than small wallets, which likely represent retail users. However, these patterns vary significantly by chain.

Large wallets ($100K+) cluster around different financial hubs by chain

Ethereum: Concentrated between UTC 8–16, spanning Europe, Africa, Latin America, and the U.S. East Coast—the most geographically diverse of the major chains

Solana and Base: Primarily active in the Americas, with peaks starting around UTC 13 as U.S. and Latin American markets come online

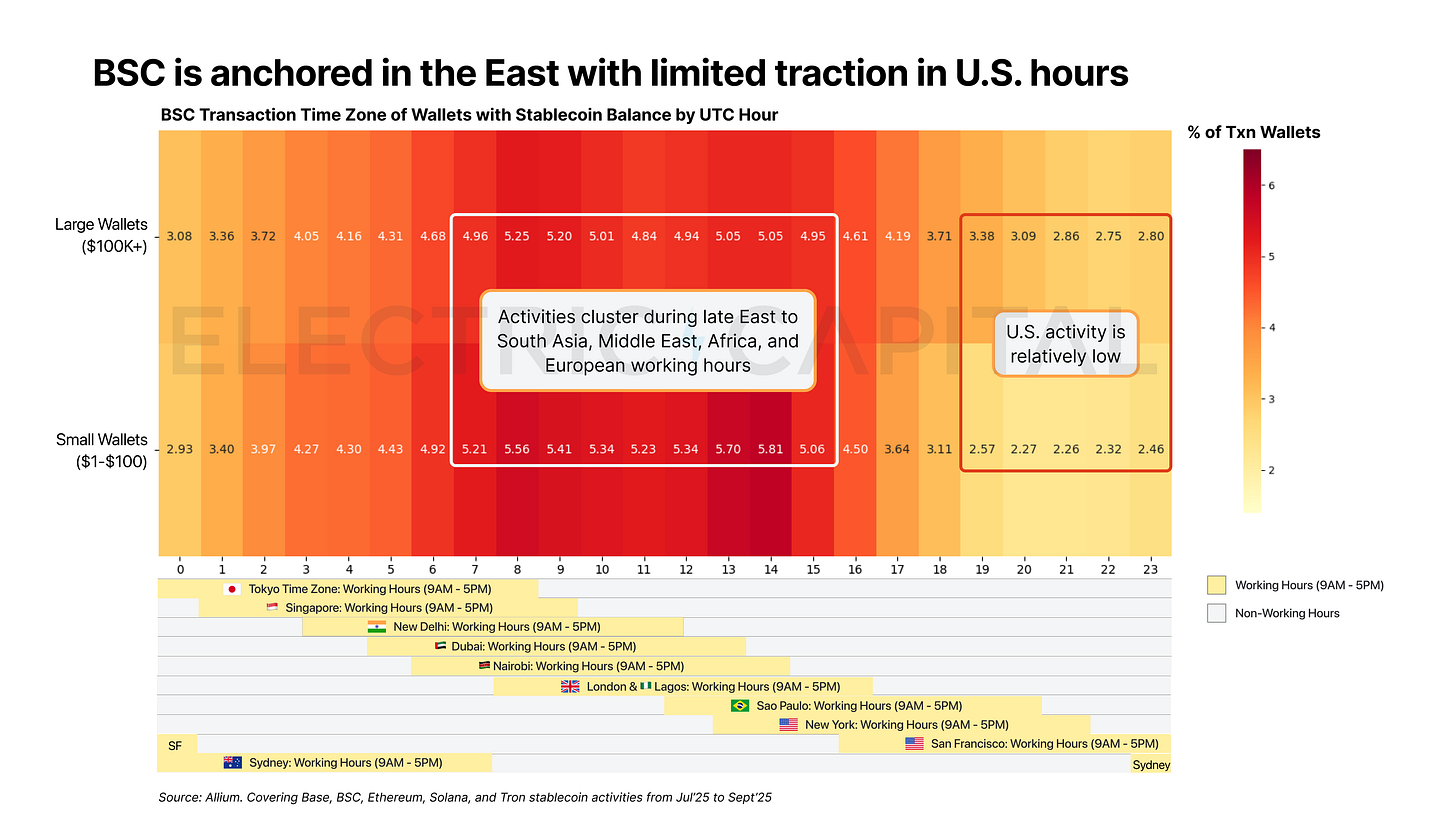

BSC: Clustered between UTC 7–15, aligning with Asia, the Middle East, Africa, and Europe, with minimal U.S. activity

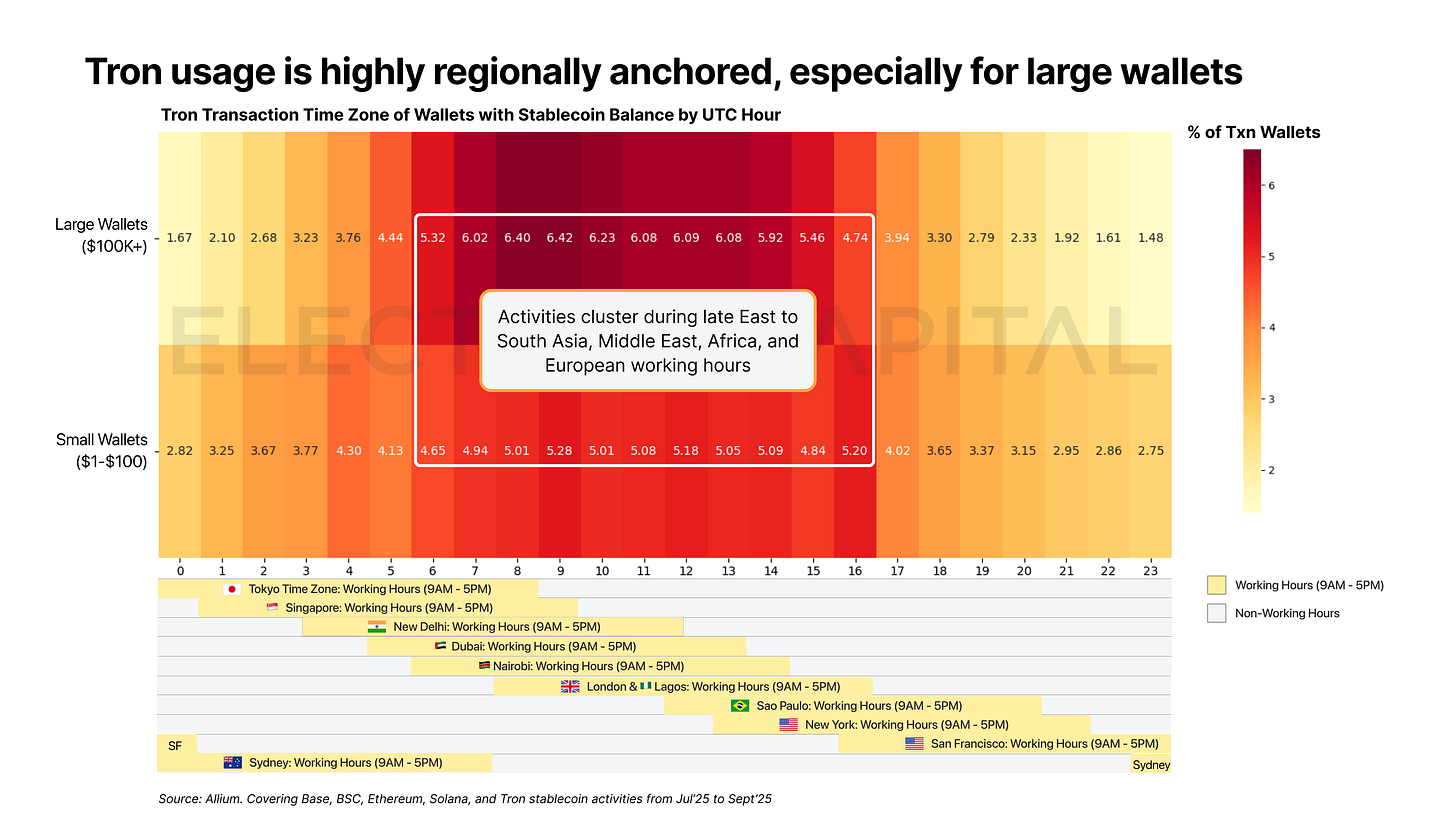

Tron: The most regionally concentrated, active between UTC 6–16, anchored in Asia, the Middle East, and Africa

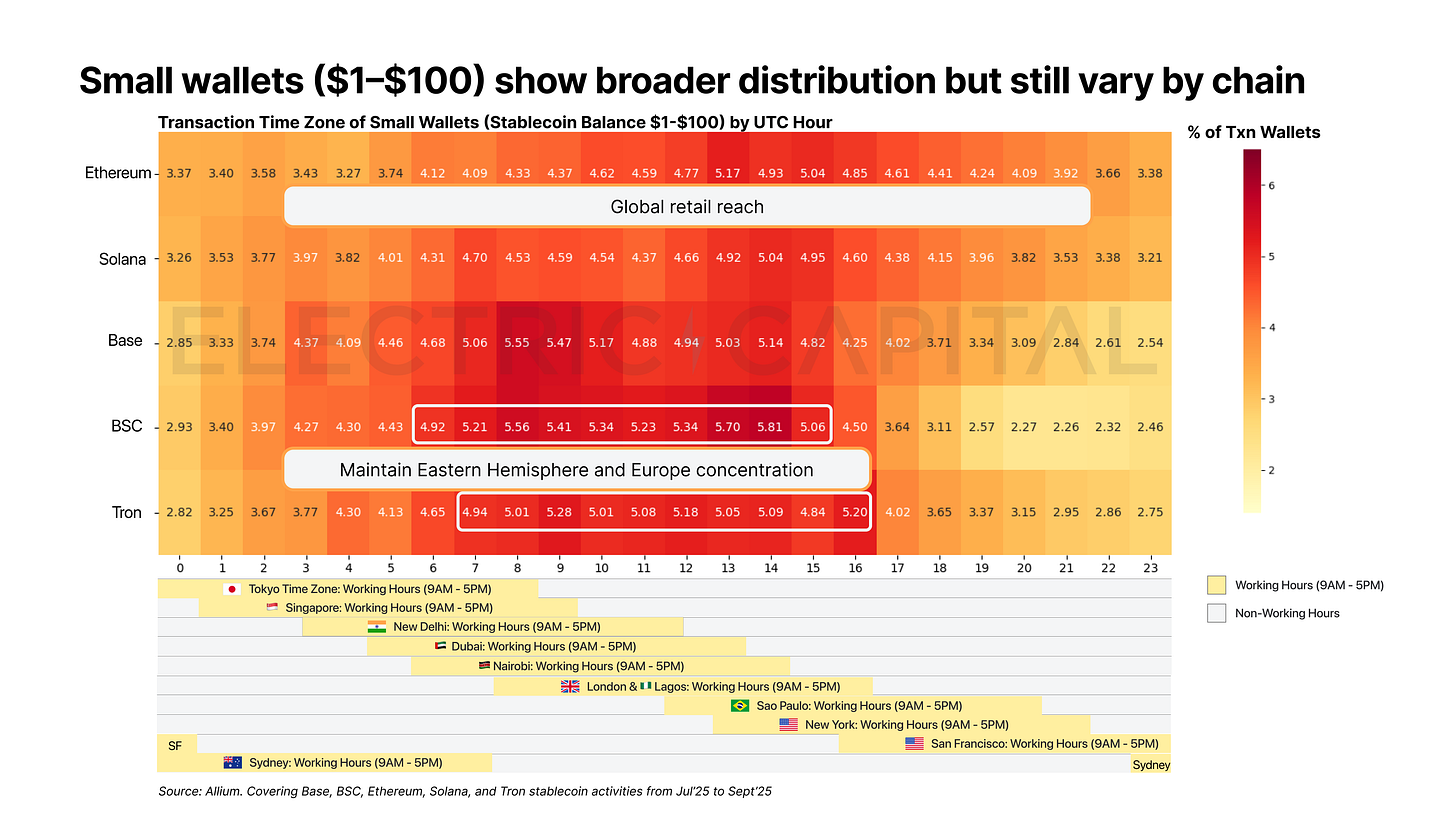

Small wallets ($1–$100) show broader distribution but still vary by chain

Ethereum and Solana: Display global retail reach with strong participation across the Americas and other regions

BSC and Tron: Maintain Eastern Hemisphere and Europe concentration, suggesting retail adoption follows the same geographic patterns as large wallets

Base: Shows Eastern Hemisphere retail strength but with emerging Western participation

Deep dive: stablecoin activity patterns on each chain

We now examine each chain individually, breaking down activity by wallet size to understand where different types of users operate on each network.

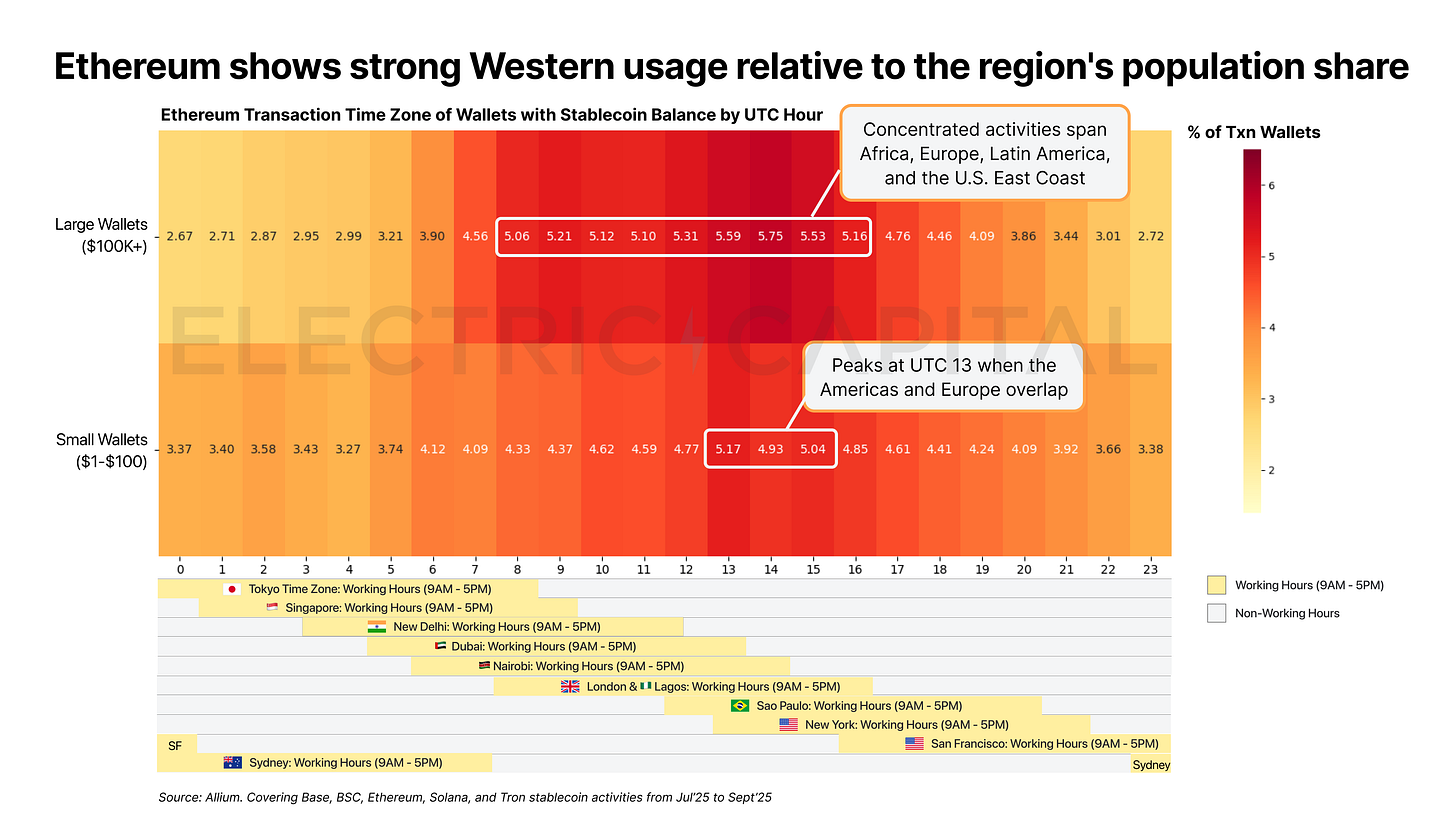

Ethereum

Ethereum maintains global distribution but shows remarkably strong Western usage relative to the region’s population share.

Large wallets ($100K+): Activity concentrates between UTC 8–16, with peak engagement spanning Africa, Europe, Latin America, and the U.S. East Coast.

Small wallets ($1–$100): Activity peaks at UTC 13 when the Americas and Europe overlap. Despite the Western Hemisphere’s smaller population, per-capita usage rates significantly exceed other regions.

Ethereum’s user base spans the globe, but Western users—both large and small wallets—engage at disproportionately high rates relative to their population share.

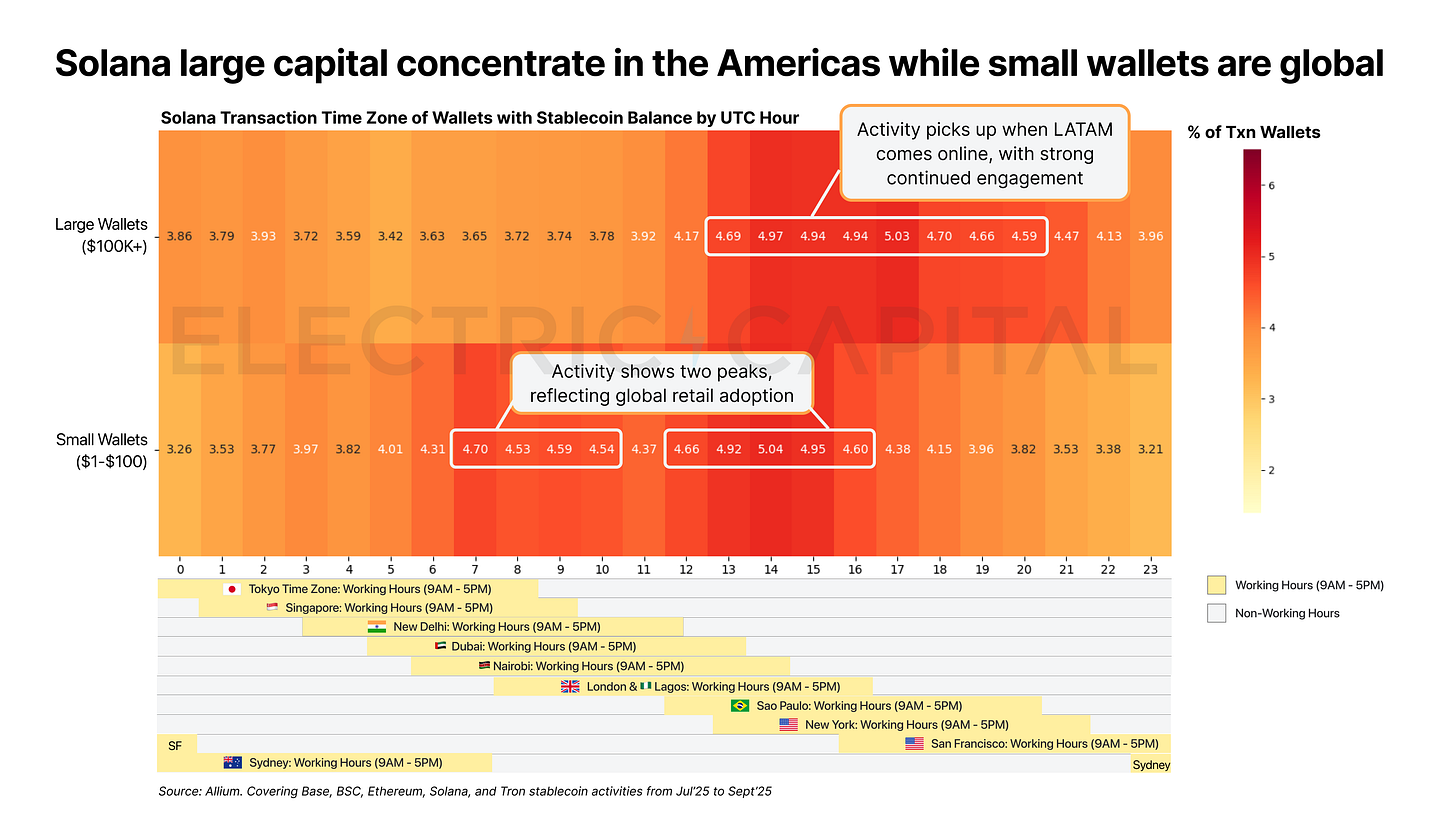

Solana

Solana shows geographic separation between large and small wallets: large capital concentrates in the Americas while small wallet users are globally distributed.

Large wallets ($100K+): Activity begins at UTC 13 as the U.S. East Coast and Latin America come online, with strong continued engagement through UTC 16. The U.S. West Coast shows the highest per-capita usage of any region globally.

Small wallets ($1–$100): Activity shows two peaks at UTC 7–10 (Asia/Middle East/Africa/Europe overlap) and UTC 12–16 (Europe/Latin America/North America overlap), reflecting global retail adoption.

Solana has a clear institutional-retail geographic divide: large wallets cluster in Western financial hubs while small wallets transact across all time zones.

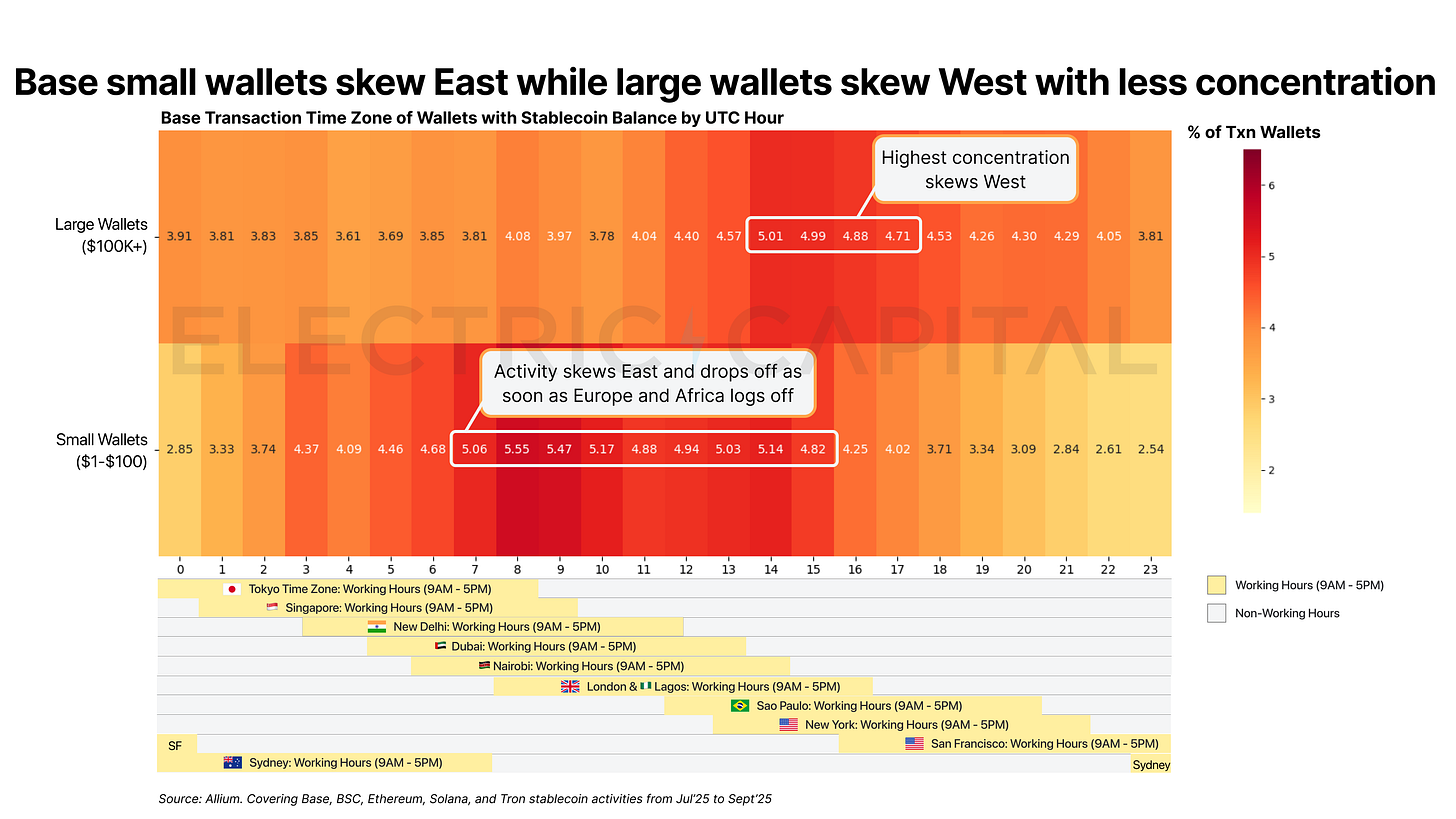

Base

Base has the sharpest geographic divide between large and small wallets: Small wallets skew East while large wallets skew West, with large wallet activity more distributed than small wallets.

Large wallets: The most concentrated hour is UTC 14, overlapping Europe, Africa, LATAM, and the U.S. East Coast.

Small wallets: Follow the general cross-chain trend but skew more heavily eastward. Usage drops sharply as soon as Europe and Africa log off.

BSC

BSC is anchored in Eastern Hemisphere users, with limited traction in U.S. hours.

Large & small wallets: Both cluster between UTC 7–15, covering late East to South Asia, Middle East, Africa, and European working hours. Peaks at UTC 8 (London open) and UTC 13 (U.S. East Coast open).

Regional tilt: U.S. activity after UTC 15 is relatively low, while Asia shows a stronger presence (beginning around UTC 2).

Tron

Tron usage is highly regionally anchored, especially for large wallets.

Large & small wallets: Both show dense concentration between UTC 6–16, aligning with late East to South Asia, Middle East, Africa, and Europe.

Tron has the most concentrated large-wallet activity of any chain.

Scope & Methodology

Chains: Ethereum, Base, BSC, Tron, Solana

Time Period: July to September 2025

Transaction Type: The analysis covers transfer transactions involving 33 major fiat- and non-fiat-backed stablecoins, including USDT, USDC, USDe, DAI, USDS, FDUSD, USD₀, crvUSD, FRAX, USDX, USR, USDZ, TUSD, PYUSD, BUSD, MIM, M, EURC, XSGD, USDP, DEUSD, USDG, USDD, GHO, DOLA, USDA, GYEN, GUSD, EURS, USDM, and RLUSD

A small number of known contract or test addresses were excluded to remove noise and ensure only genuine wallet activity was counted

Wallet filter: We used each wallet’s stablecoins balance at the start of the month as a proxy for its size. Wallets with starting balances below $1 were excluded from that month’s analysis.

Methodology:

To measure when users are most active, we counted each wallet once per hour of activity per month

If a wallet made multiple transfers during a UTC hour in two of the three months, it was counted twice

If a wallet made multiple transfers within the same hour in the same month, it was counted once for that month

When aggregating activity across chains (e.g., all wallets or large vs. small wallets), we removed duplicates across EVM-compatible networks (Ethereum, Base, BSC, and Tron) to ensure each wallet was counted only once

Love the concept of the analysis but is there evidence to support the major assumption that working hours are 9-5 amongst stable coin users. If thats not true the inferred geographies fall down