Beyond Stablecoins: The Case for Ethereum

Download the PDF report here:

Note: Throughout this article, ‘Ethereum’ refers to the network, and ‘ETH’ to the asset that powers it.

Executive Summary

The global demand for US dollars is not declining—it is exploding. While headlines focus on de-dollarization, a far more significant trend is unfolding: 4B+ people and millions of businesses are actively seeking dollar access through stablecoins, representing the largest expansion of the dollar's network effects in decades.

This creates an unprecedented opportunity for Ethereum. As stablecoins provide access to dollars to individuals around the world—growing 60x since 2020 to over $200B—millions of new dollar holders need more than just digital cash. They need yield, investment opportunities, and financial services. Traditional finance cannot serve this massive new market due to regulatory and infrastructure constraints.

Ethereum is uniquely positioned to host the global financial infrastructure for this new digital dollar economy, and ETH stands to benefit directly from this growth.

1. Millions of New Dollar Holders Enter Through Stablecoins

There is massive latent global demand for US dollars, both from individuals and businesses.

Individuals around the world want dollars for security:

Over 4 billion people face significant currency risks due to political instability, poor monetary policy, and structural inflation.1

An estimated 21% of the world’s population lives in countries with annual inflation above 6%2, eroding savings and purchasing power rapidly.

For these populations, holding dollars means financial security. Dollars are trusted as a store of value, a means to transact cross-border, and a way to hedge against local currency volatility.

Businesses want dollars to transact:

The dollar remains the dominant currency for global trade, with 88% of all global foreign exchange (FX) transactions involving USD on at least one side.3

Businesses in emerging markets, where local banking and FX markets are often limited or unstable, rely on dollar liquidity for international payments, imports, and supply chains.

SMEs and freelancers increasingly demand digital dollars to get paid and avoid currency mismatch risks.

For the first time in history anyone in the world can hold dollars via stablecoins:

Anyone with internet access can hold and transact in dollars—no banks required, no government permission needed, 24/7 global availability.

As a result, stablecoin market capitalization grew 60x since 2020.4

Peak adoption is concentrated in emerging markets previously excluded from dollar-denominated finance. Nigeria became the #2 global crypto market while China sees underground adoption despite prohibitions.5

Stablecoins are creating a new class of dollar holders across the world's largest populations—businesses pricing in USDT, families saving in USDC. They enable a fundamental expansion of the USD financial services market.

2. These New Dollar Holders Seek Yield, Creating Opportunity for New Global Financial Infrastructure

Stablecoin holders want to put their money to work.

Millions of people can now hold dollars through stablecoins. But they want to do more than just hold dollars. People and businesses naturally want to put their money to work earning yield, investing, and growing wealth.

Traditional finance cannot serve this new market:

US banking system requires regulatory compliance that excludes most global participants.

Cross-border financial services remain expensive, slow, and geographically restricted.

Traditional finance was built for institutions and high-net-worth individuals, not global retail.

Geographic and regulatory barriers prevent billions from participating in dollar-denominated finance.

This creates demand for new financial infrastructure that can serve billions of stablecoin holders globally, allowing them to put their new dollars to work.

3. Only Ethereum Meets All Three Requirements to Serve Stablecoin Holders Globally

New financial infrastructure to serve stablecoin holders must meet three critical requirements simultaneously:

Accessible Globally – Must work for anyone with internet access, from New York to Nigeria to rural Nepal. Most of the world cannot access dollar-based finance due to geography or regulation.

Safe for Institutions – Must provide the security, reliability, regulatory clarity, and customizability that institutions need to build billion-dollar financial products.

Resistant to Government Interference – Must operate beyond the control of any single government, since many governments would prefer to restrict dollar access to protect local currencies and control capital flows.

Ethereum delivers on all three requirements:

Accessible Globally: Ethereum is available 24/7 to anyone with an internet connection worldwide.

Safe for Institutions:

Secure – Most economic security, and most decentralization, of any programmable blockchain. Most mature security infrastructure - most open source developers, verified contracts, security auditors & tooling.

Reliable – 100% uptime for 10 years through market crashes and geopolitical events.

Regulatory-Compliant – ETH classified as commodity by US regulators providing a clear institutional framework.

Customizable – Ethereum's L1+L2 framework enables customizability, allowing institutions to optimize for specific use cases and meet regulatory requirements (e.g., Coinbase and Robinhood both built L2 chains on Ethereum).

Proven Track Record – Hosts the world's largest digital financial economy: $140B+ USD stablecoins6, $60B+ in decentralized finance (DeFi) protocols7, and $7B+ real-world asset tokenization.8

Resistant to Government Interference: No single point of control that can be captured by governments to control or restrict the network.

Ethereum uniquely delivers on these requirements due to its strong decentralization — rooted in an origin story that is nearly impossible to replicate today.

Strong decentralization is what makes Ethereum globally accessible, secure, reliable, and resistant to government interference.

This level of decentralization is rooted in Ethereum’s origin and culture.

Ethereum launched as a community-funded, proof-of-work chain, giving it very broad asset ownership. Today’s environment makes it no longer feasible to launch in this manner.

Its culture consistently prioritizes decentralization— maintaining costly client diversity and resisting centralized shortcuts—a culture that is nearly impossible to retrofit.

The result is a decentralization advantage that other chains cannot easily copy, and a lasting moat for Ethereum.

No other alternative meets all three requirements simultaneously:

* Bitcoin may become more programmable in the future, but only if the Bitcoin community can agree to make an opcode change to enable this functionality.

4. Demand for ETH Will Likely Increase as it Becomes the Reserve Asset of the New Digital Dollar Economy

What is a reserve asset?

In any financial system, a reserve asset is the trusted base layer that underpins everything else. It is what institutions, protocols, and users hold as collateral, savings, or liquidity—the asset they rely on to store value, back loans, and settle transactions.

In the traditional system, dollars, US Treasuries, and gold are examples of reserve assets because they are trusted, liquid, and widely accepted.

Why ETH naturally plays this role

As billions of dollars flow through stablecoins on Ethereum, participants need a secure, permissionless, and productive asset to back lending, borrowing, staking, and yield generation. ETH is uniquely suited for this because:

Scarce & trusted: ETH’s supply is predictable, with low inflation and no central control.

Productive: Unlike gold or static dollars, ETH generates yield through staking—similar to how real estate or Treasuries generate income while held.

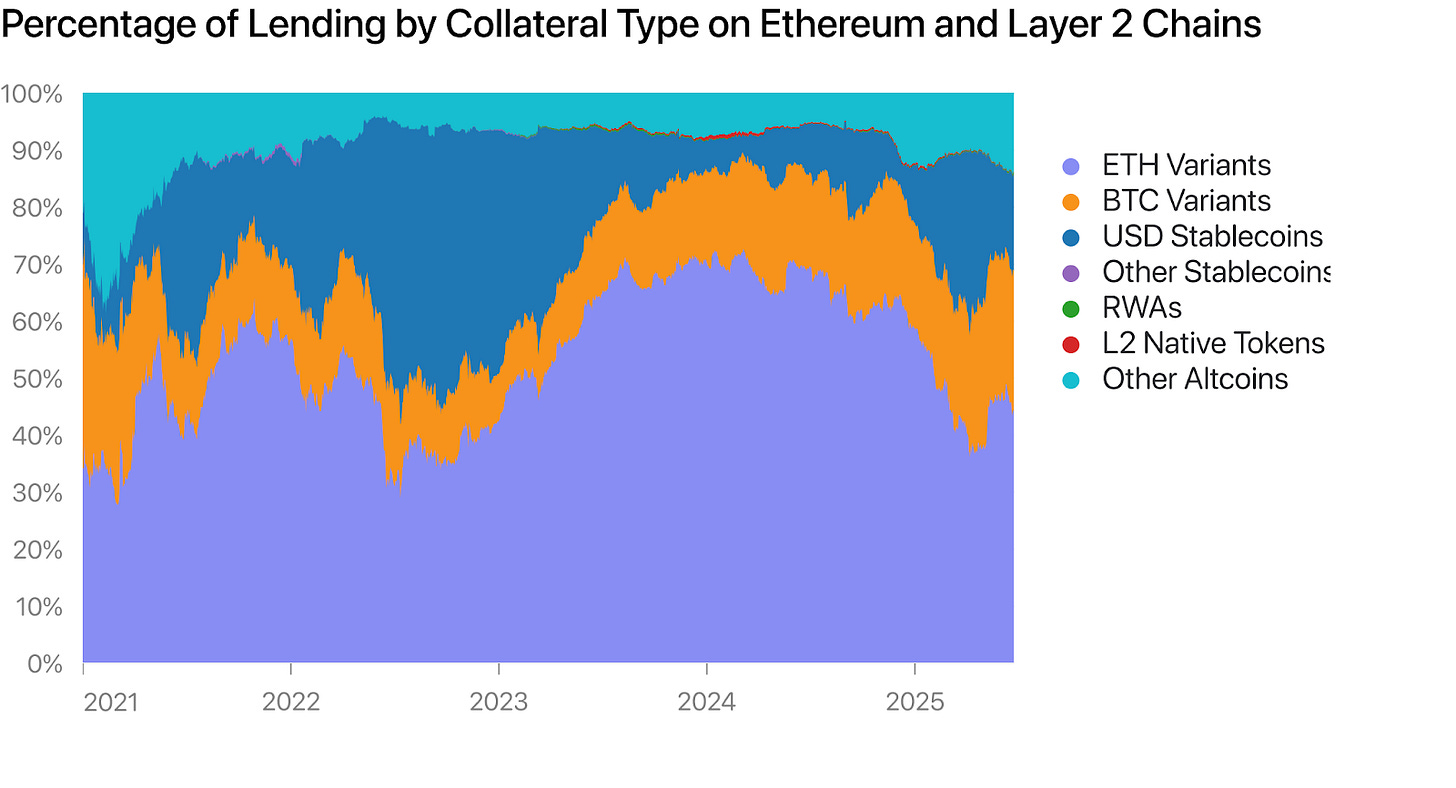

Collateral utility: ETH is already the largest on-chain collateral asset in the Ethereum ecosystem, backing $19B+ in lending protocols12. Institutions hold it because they need it to access DeFi markets.

Seizure-resistant & censorship-resistant: ETH cannot be frozen or seized by governments, making it more resilient than centrally issued assets.

Programmable & liquid: ETH is deeply integrated into the entire on-chain financial system, with unmatched liquidity for large transactions.

Why this makes ETH valuable

As more users hold stablecoins and demand financial services, they need a reserve asset to power that activity. ETH earns yield, secures the network, and underpins DeFi lending—so demand for ETH naturally grows as the system grows.

In simple terms: more stablecoin adoption → more on-chain activity → more need for ETH as collateral → more ETH held by institutions and users.

L2s expand demand for ETH

The growth of Ethereum L2s further boosts demand for ETH. By making transactions cheaper and faster, and enabling new use cases, L2s open up more places where ETH can be used as collateral. This expands the reach of ETH and strengthens its role as the reserve asset for the digital dollar economy.

5. As Demand for ETH increases, it is also Positioned To Become A Global Store of Value

This growing demand for ETH also positions it to take a large share of the legacy store of value market.

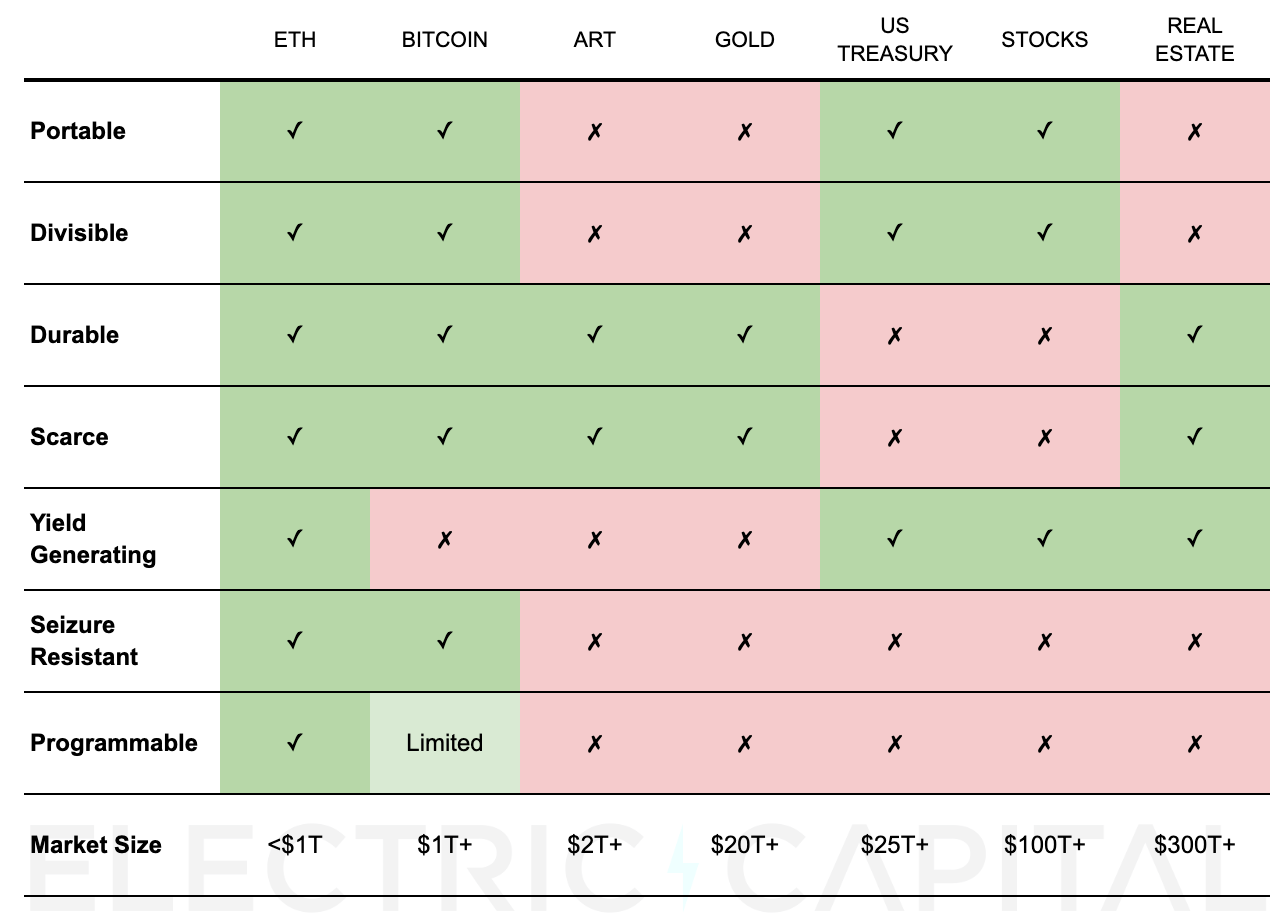

Like Bitcoin, Ethereum has superior store of value (SoV) properties to traditional assets like gold.

Rather than competing against each other, ETH and BTC may both take share from the $500T of legacy SoV assets in the coming years (gold, treasuries, stocks, real estate).

In addition to the SoV properties of Bitcoin, ETH also provides holders with yield.

Yield generation is a major unlock as investors overwhelmingly prefer yield-generating assets. US households hold ~$32T in dividend paying stocks13, while they hold <$1T in gold.

ETH has superior properties to legacy SoV assets, and also provides yield:

6. Conclusion: Holding ETH is Likely the Best Way to Gain Exposure to the Growing Stablecoin Economy

The growth of the stablecoin economy sets up a powerful flywheel for Ethereum and ETH.

As more stablecoins are put to work on Ethereum, demand for ETH strengthens. A higher ETH value and more secure network attract more institutions and services, which fuels even greater stablecoin adoption.

Alternatives face significant challenges in replicating this flywheel:

Traditional finance cannot serve billions excluded by geographic and regulatory barriers.

Government-controlled systems remain subject to political influence and jurisdictional limitations.

Bitcoin lacks the programmability for complex financial services.

Other blockchains lack the security, reliability, and customizability needed by institutions, and also lack the decentralization to make them resistant to government interference.

The result: Holding ETH is likely the simplest and most effective way to gain exposure to the growing stablecoin economy.

One can also choose to invest in specific DeFi protocols that benefit from stablecoin expansion. This is riskier and requires expertise.

For most retail and institutional participants, ETH offers the simplest exposure to the entire digital dollar ecosystem.

Appendix

Risks to Watch

Like any emerging global system, Ethereum faces meaningful risks. While there are a number of risks, three stand out as the biggest threats to the thesis that Ethereum will anchor a permissionless, dollar-based financial system with ETH as its reserve asset.

1. Dollars Become the Reserve Asset, Not ETH

If stablecoins like USDC or USDT become so dominant that they are used for lending, collateral, and settlement, dollars could effectively replace ETH as the system's reserve asset. In this scenario, ETH risks being seen primarily as "gas money" rather than a core store of value. However, displacing ETH appears challenging given it maintains 44% of on-chain lending collateral on Ethereum mainnet and L2s and generates 3-5% staking yields. More importantly, ETH is the only truly decentralized asset on Ethereum—stablecoins like USDC and USDT are centrally controlled and can be frozen or seized, making them fundamentally unable to fulfill ETH's role as censorship-resistant collateral. More likely, ETH and dollars play complementary roles—dollars optimizing for stability and transactions, ETH providing decentralized, seizure-resistant value storage and network ownership.

2. CBDC Competition Displaces USD Stablecoin Adoption

Central Bank Digital Currencies (CBDCs) could offer similar 24/7 digital dollar access with full sovereign backing, potentially crowding out private stablecoins and limiting the permissionless dollar-based system that Ethereum enables today. CBDCs are inherently national, often lack true cross-border interoperability, and will likely restrict open developer access due to compliance and identity requirements. Stablecoins, by contrast, already settle trillions annually, work globally by default, and remain far more flexible for innovation, making it challenging for CBDCs to displace them.

3. A Competing Chain Overtakes Ethereum

A faster, cheaper blockchain with less initial decentralization could win users and developers who prioritize low fees and simple UX, creating strong liquidity and network effects early on. Over time, that chain might mature its validator set enough to be “decentralized enough,” fragmenting Ethereum’s dominance. However, displacing Ethereum would be difficult given its decentralization and 10+ years of battle-tested security.

Additional Data

$6T+ in annual stablecoin settlement volume (10x from 2020):14

Ethereum hosts 55%+ of all stablecoins:15

ETH may be the reserve asset of the new financial system. 44% of lending collateral is ETH in the Ethereum ecosystem, making it the largest collateral asset ($19B):16

This post reflects the current opinions of the authors and individual Electric Capital Partners, LLC (“Electric Capital”) personnel and are not the views of Electric Capital, its affiliates, or other individuals associated with Electric Capital. Certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Electric Capital has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://electriccapital.com/disclosures for additional important information.

Electric Capital and/or one or more of its affiliates is an investor in ETH. While we believe in Ethereum’s potential, this post is intended to share insights about Ethereum’s role in the future of finance rather than promote our investment. Readers should conduct their own research and consider multiple perspectives.

WPR 2025 population tables: CN 1.43 + IN 1.43 + NG 0.22 + RU 0.14 + LatAm 0.67 + SE Asia 0.70 = ≈ 4.6 bn under FX controls / withdrawal limits (per IMF AREAER ’24). Accessed 23 June 2025. worldpopulationreview.com.

International Monetary Fund (IMF). World Economic Outlook (WEO) database, April 2025 edition—“Inflation rate, average consumer prices (percent change)” series. Accessed July 7, 2025. https://www.imf.org/external/datamapper/PCPIPCH@WEO

Bank for International Settlements (BIS). OTC Foreign Exchange Turnover in April 2022 (Triennial Central Bank Survey). Accessed June 30, 2025. https://www.bis.org/statistics/rpfx22_fx.htm

StablePulse. Stablecoin analytics dashboard. Accessed June 23, 2025. https://www.stablepulse.org/

Chainalysis. The 2024 Geography of Cryptocurrency Report (1 Oct 2024). Accessed June 23, 2025. https://www.chainalysis.com/wp-content/uploads/2024/10/the-2024-geography-of-crypto-report-release.pdf

StablePulse. Stablecoin analytics dashboard. Accessed June 23, 2025; Stablecoins on Ethereum include stablecoins on Ethereum mainnet, Arbitrum, Base, Optimism as the major L2s. https://www.stablepulse.org/

DefiLlama API. Accessed June 23, 2025; Total Value Locked (TVL) in decentralized finance on Ethereum include value locked on Ethereum mainnet and major L2s.

RWA.xyz. Networks overview page. Accessed June 23, 2025. https://app.rwa.xyz/networks

Beaconscan. Ethereum Mainnet Beacon Chain Explorer. Accessed June 30, 2025. https://beaconscan.com/

Ethernodes. Countries – The Ethereum Network & Node Explorer. Accessed July 3, 2025. https://www.ethernodes.org/countries

Developer Report. Developer Ecosystem Rankings. Accessed July 3, 2025. https://www.developerreport.com/

DefiLlama API. Accessed June 23, 2025; Collateral assets in lending on Ethereum include assets locked on Ethereum mainnet and major L2s. Graph includes all variants of ETH (ETH, WETH, LSTs, LRTs).

Fed Z.1 (YE 2024) corporate equities: $39.4 T. — S&P DJI PR, 7 Jul 2025: 407/503 S&P 500 pay dividends ⇒ $39.4 T × 0.809 ≈ $32 T.

Allium on-chain stable-coins data. Entity-adjusted, single-direction max/net transfer methodology (see documentation). Accessed Jun 23 2025. https://docs.allium.so/historical-data/stablecoins

StablePulse. Stablecoin analytics dashboard. Accessed June 23, 2025. https://www.stablepulse.org/

DefiLlama API. Accessed June 23, 2025; Collateral assets in lending on Ethereum include assets locked on Ethereum mainnet and major L2s. Graph includes all variants of ETH (ETH, WETH, LSTs, LRTs).